Consumer Due Diligence

The global experience of our advisors and analysts span across both developed and emerging markets and across Commercial Banking, Retail Banking, Consumer Finance, Credit Cards, Unsecured & Secured Lending. We apply this collective experience to provide an objective view and in-depth analysis of the client's target portfolios with details of the Risk Management Framework, Strategy, Policy and Credit Operations.

Our advisory service includes:

Portfolio Due Diligence Services including :

- Loss Forecasting – Model Development

- Net flow models, Markov Chain models

- Delinquency & Loss Analysis,

- Vintage Analysis.

- Provisioning Models

- Scenario based Loss Forecasts & Provisioning Requirements

- Growth and Loss Projections

- Exposure & Loss Analysis: Portfolio Review to identify At-Risk accounts and ring-fence potentially "bad" portfolio for work-out.

· Stress Testing – Design & Implementation

- Stress test Loss forecasts and Provisioning requirements

- Calculate Unexpected Losses

Commercial Due Diligence

Commercial Portfolio Due Diligence Methodology

Review of Audit Reports and Prior Review Result

Data Tape Analysis for High Level Portfolio Review :

- Segmentation Analysis by Industry/Customer Concentration, Branches, Collateral Types, Loan Types, Loan Size, and Loan Classifications

- Collateral Coverage Analysis & Evaluation

Emphasis on File Review :

- Reasonable Sampling Size to ensure adequate coverage of exposure & risk

- Sampling by Loan Size, Loan Types, & Loan Classification

- Covers most of Non-Performing Loans & Impaired Loans

- Full File Review on Top 10 or 20 Group Loans (depending on coverage)

- Collateral Quality Review and Assessment of Exposures

- Estimation of LGD & PD by Risk Categories for Loss Estimation

- Inter-company and related-party exposures

Validation of Loss Provisions Adequacy

Identify if any Concentration Risk

Assessment of Line Management Strategy, Loan Review Process, Early Warning Process, and Collateral Appraisal Process

Validation of Internal Risk Rating or Scorecard Effectiveness

Restructuring

The Axslogic team has extensive experience in assisting private equity and financial institutions with review, assessment, restructuring and enhancement of consumer and commercial banking, securization and financing portfolios.Areas of expertise include new account sourcing techniques, actively management the portfolios to ensure that inherent and latent risks were identified and proactively addressed, portfolio profitability to adequately cover the associated risks, appropriate and accurate loss forecasting and provisioning methodologies and specific customized collection/recovery strategies to be used for each respective portfolio.

Product Planning and Design

- Evaluate Industry, competition and fitment within industry of the current client offerings.

- Review of value proposition of the products and services offered by the client, the mix of products and existing product strategies

- Assess ability of products and services to endure in a changing marketplace

- Provide recommendation on new product structures that have high probability of success in the marketplace

- Develop associated new product programs while also reviewing and validating existing programs and profitability dynamics

- Creation of customer segments for different products.

- Design of Cross Sell strategy using the customer segmentation

- Upgrade and conversion across products e.g. from private label to co-brand

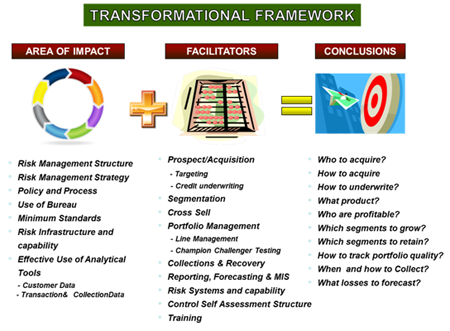

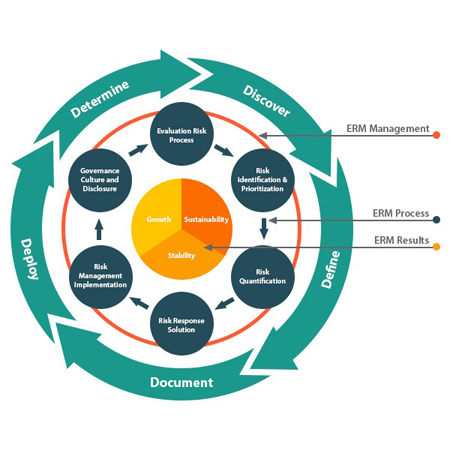

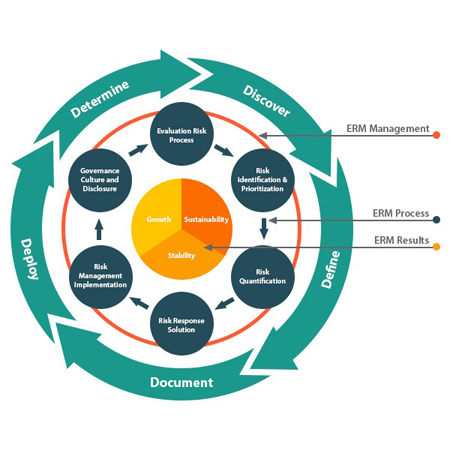

Risk Framework

- Evaluate suitability of the policy/strategy to the business growth goals in context of competition and the current market conditions.

- Evaluate the Risk Management organization structure :

- Assessment of existing talent and suitability of resources,

- Development of Job Scopes for each critical resource in the proposed risk management organization,

- Development of capacity plans and assessing appropriate levels of staffing.

- Conduct assessment of Risk Tools and recommend alternatives if necessary.

- Development of a Risk Management Control Framework

- Development of minimum standards across key stages in the credit and fraud cycle. Development of appropriate performance benchmarks

- Periodic portfolio reviews to ensure portfolio quality, identify nascent issues and suggest corrective measures'

- Evaluating the effectiveness of the strategies in force in light of the portfolio performance,

- Development and subsequent evaluation of world-class operational risk framework, self assessment process and other control processes,

- Assist in conducting Risk Reviews and evaluating audit results.

Risk Strategy

- Development of a Risk Management Strategy framework for the organization.

- Strategies to cover all aspects of the credit cycle including acquisition, portfolio management and collections

- Development of product specific analysis strategies for Acquisition, Portfolio and Collections

- Developing a precise and focused bureau strategy to ensure portfolio quality.

- Evaluate Credit Policy and processes.

- Review all aspects of credit policy and evaluate potential improvements,

- Restructure the policy documents for each product line to align with industry best practices,

- Developing detailed process documents outlining each risk process for all products,

- Evaluate data management capabilities and proposed management business review process

- Development of detailed business review decks for monitoring of profitability, portfolio and processes across products in line with the segmentation strategies

Collections and Fraud Management

- Collection Management

- Review and restructuring of collection strategy,

- Review of functionality and effectiveness of score cards and analytics associated with decision making

- Review collection efficiency framework and productivity management

- Development of policy, strategy and process driven collection framework.

- Fraud Risk Management (internal and external fraud)

- Assist in developing the Broker, Dealer and Branch Channel fraud risk management infrastructure,

- Assist in creating a strong Investigations unit for analyzing the fraud trends and syndicated activities,

- Assist in developing a detailed Fraud Risk Management reporting system,

- Sampling process of non-starters and early delinquency for proper identification and accounting of fraud vs. credit,

- Evaluate fraud tools and offer best practice solutions as required,

- Evaluate the Fraud Management tools, capability, utility, productivity and possible areas of improvement

Forecasting and Provisioning

- Forecasting of all financial indicators including revenue, loss and expenses for different product segments

- Exposure & Loss Analysis: Identification and management of risky accounts to target potentially "bad" portfolio for work-out.

- Loss Forecasting – Model Development

- Roll Rates/Markov Chain models

- Delinquency & Loss Analysis

- Vintage Analysis

- Provisioning Models

- Scenario based Loss Forecasts & Provisioning Requirements

- Model Validation and Implementation

- Stress Testing – Design & Implementation

- Stress test Loss forecasts and Provisioning requirements

- Calculate Unexpected Losses